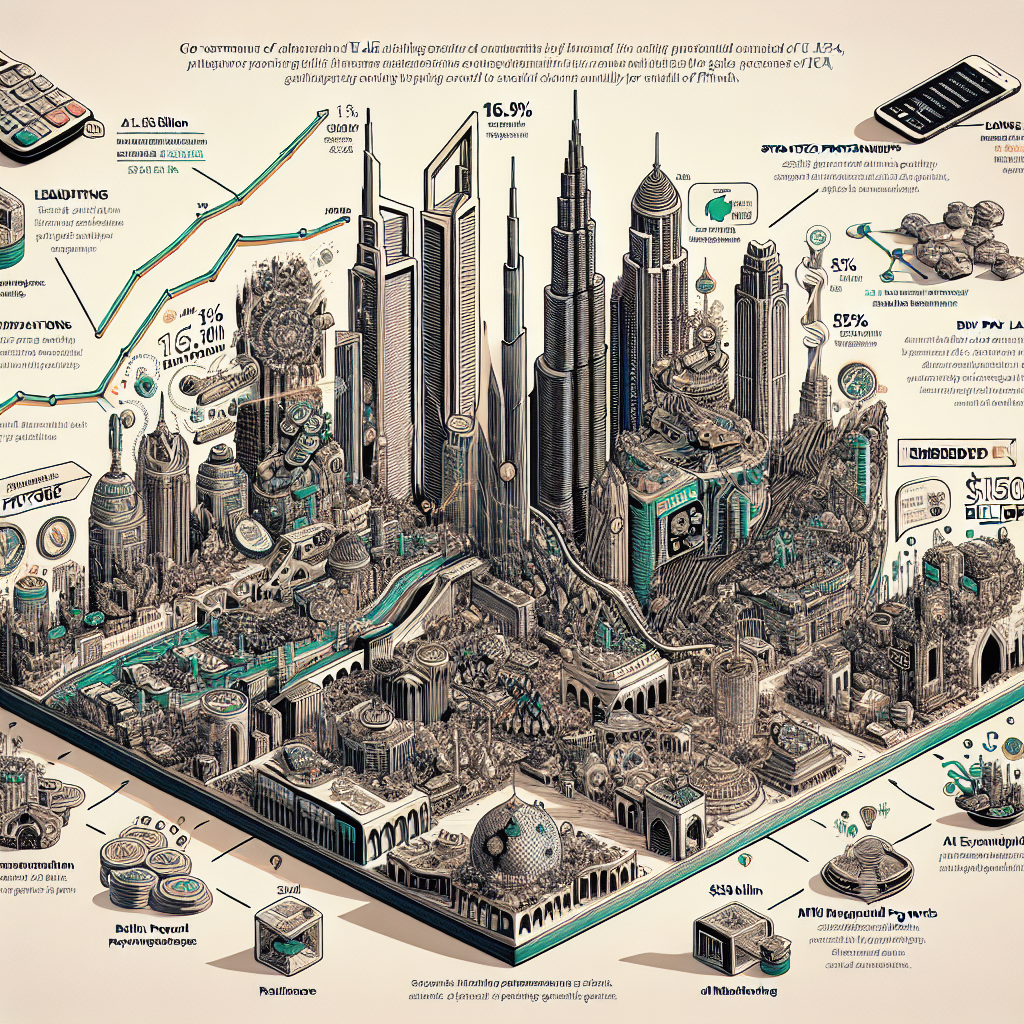

The UAE’s embedded finance sector is on track for significant growth, with projections indicating a 16.1% annual increase to reach $1.56 billion in 2024. By 2029, the industry is expected to expand to approximately $550 billion, driven by strong governmental support and increasing consumer demand.

Key factors fueling this growth include government initiatives like the Future and Dubai International Financial Centre (IFC), which create a favorable regulatory environment for fintech innovation. The UAE’s focus on e-commerce and integrated financial solutions, such as ‘buy now, pay later’ (BNPL) and unified payment gateways, aligns with broader economic strategies aimed at enhancing digital adoption and consumer convenience.

Strategic partnerships and innovations

Recent developments highlight the sector’s dynamism. Al Etihad Payments’ collaboration with Core42 to implement Open Finance in the UAE marks the beginning of a new era in financial services integration. This partnership is part of the Central Bank of the UAE’s (CBUAE) Financial Transformation Programme, aimed at improving access to financial products for consumers and businesses.

The Mitgo Group’s acquisition of the UAE-based embedded finance platform Embedded is another significant move, enabling Mitgo to offer integrated financial solutions to its affiliate clients. The company aims to facilitate over 7% of the affiliate transaction volume, which is projected to exceed $1.5 billion within three years.

Market segments and opportunities

The embedded finance landscape in the UAE spans various sectors, including lending, insurance, payment, and wealth and asset-based finance. Substantial growth is observed in retail, logistics, telecommunications, manufacturing, and consumer health sectors.

The supportive regulatory environment, including the CBUAE’s initiatives, positions the UAE as a leader in financial technology innovation. As the embedded finance sector continues to evolve, it is expected to play a crucial role in the country’s financial and economic development in the coming years.